Editor’s note: Tim Merel is the managing director of Digi-Capital.

Editor’s note: Tim Merel is the managing director of Digi-Capital.Virtual reality and augmented reality are exciting – Google Glass coming and going, Facebook’s $2 billion for Oculus, Google’s $542 million into Magic Leap, not to mention Microsoft’s HoloLens. There are amazing early-stage platforms and apps, but VR/AR in 2015 feels a bit like the smartphone market before the iPhone. We’re waiting for someone to say “One more thing…” in a way that has everyone thinking “so that’s where the market’s going!”

A pure quantitative analysis of the VR/AR market today is challenging, because there’s not much of a track record to analyze yet. We’ll discuss methodology below, but this analysis is based on how VR/AR could grow new markets and cannibalize existing ones after the market really gets going next year.

AR is from Mars, VR is from Venus

VR and AR headsets both provide stereo 3D high-definition video and audio, but there’s a big difference. VR is closed and fully immersive, while AR is open and partly immersive – you can see through and around it. Where VR puts users inside virtual worlds, immersing them, AR puts virtual things into users’ real worlds, augmenting them.You might think this distinction is splitting hairs, but that difference could give AR the edge over not just VR, but the entire smartphone and tablet market. There are major implications for Apple, Google, Microsoft, Facebook and others.

Where’s the beef?

VR is great for games and 3D films – that’s what it was designed for. However it is primarily a living room, office or seated experience, as you might bump into things if you walked down the street wearing a closed headset. It’s still a great technology with a ready and waiting user base of tens of millions among console, PC and MMO gamers, those who prefer 3D to 2D films, as well as niche enterprise users (e.g. medical, military, education). This has attracted a growing apps/games ecosystem around early players like Unity, Valve, Razer and others.AR is great fun for games, but maybe not as much fun as VR when true immersion is required – think mobile versus console games. But that possible weakness for gamers is exactly why AR has the potential to play the same role in our lives as mobile phones with hundreds of millions of users. You could wear it anywhere and do anything. Where VR is like wearing a console on your face (Oculus), AR is like wearing a transparent mobile phone on it (Magic Leap, HoloLens).

Eye phone

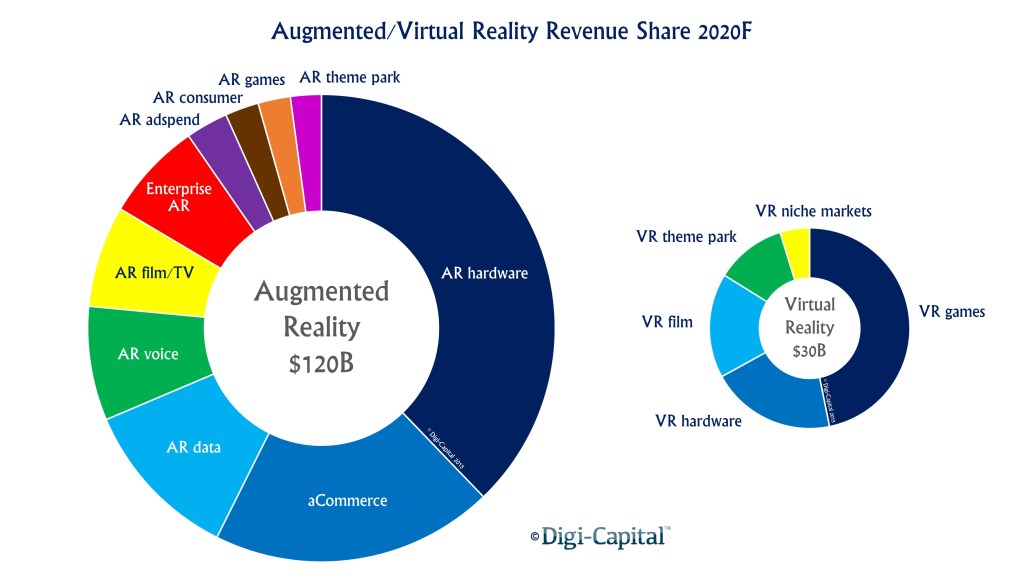

AR could play a similar role to mobile across sectors, as well as a host of uses nobody has thought of yet. The sort of things you might do with AR include a-commerce (we just invented a new cousin to e-commerce and m-commerce), voice calls, web browsing, film/TV streaming in plain old 2D as well as 3D, enterprise apps, advertising, consumer apps, games and theme park rides. So while games feature prominently in most AR demos, they are only one of a multitude of potential uses for AR. See full analysis by sector here.Real dollars

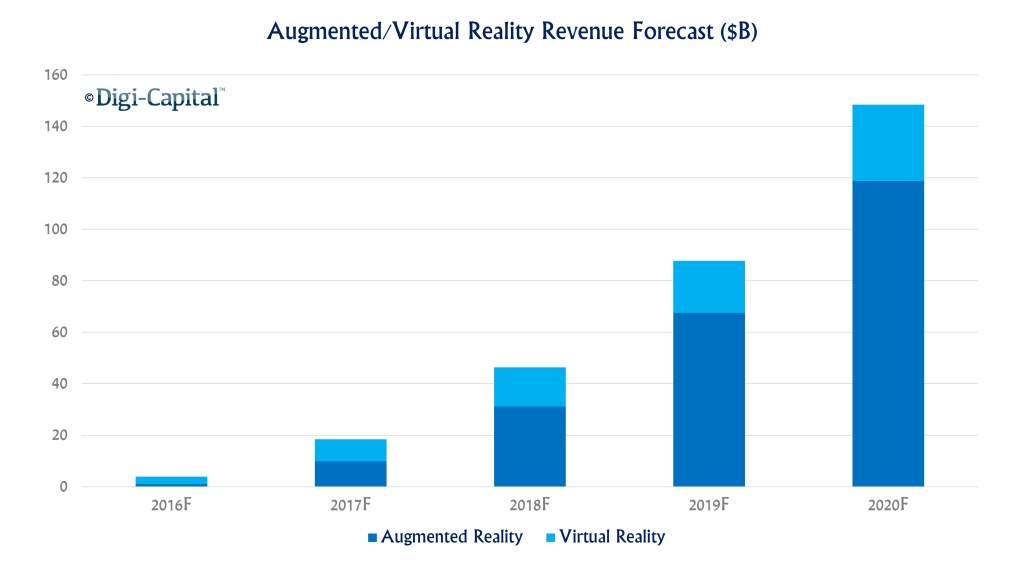

We forecast that AR/VR could hit $150 billion revenue by 2020, with AR taking the lion’s share around $120 billion and VR at $30 billion.

So where do these big numbers come from?

We think AR’s addressable market is similar to the smartphone/tablet market. So AR could have hundreds of millions of users, with hardware price points similar to smartphones and tablets. This could drive large hardware revenues for device makers.

AR software and services could have similar economics to today’s mobile market, as they both cannibalize and grow it. A large AR user base would be a major revenue source for TV/film, enterprise, advertising, and consumer apps from Facebook to Uber to Clash of Clans. Amazon and Alibaba would have an entirely new platform for selling to a mass audience. Together with innovative applications nobody has thought of yet, AR’s scale could prove a bonanza for mobile networks’ voice and data businesses. Someone has to pay for all that mobile data.

The sector forecasts by market from 2016 are covered in detail here, and below is what the market could look like in 2020. Between now and then we’ll be refining regularly as more data becomes available, and expect a lot of debate about where the market is headed.

Vomit reality and Glassholes

It’s not all virtual beer and Skittles, as some VR applications give people motion sickness, and the privacy questions surrounding Google Glass raised a lot of scrutiny. So there are both technical and social issues to resolve as both markets become real.One more thing…

From the perspective of current giants, there are pluses and minuses. Facebook placed an early bet on Oculus, which might win VR but not address the larger AR market. Google learned from Glass, and had the foresight to invest in Magic Leap. HoloLens could allow Microsoft to regain the glory it lost to Apple in the last decade. And Apple? We would love to see an augmented “One more thing…”The full analysis is here.