Blue Apron just can’t catch a break.

The New York-based cooking kit business released its third-quarter earnings before the bell on Thursday. The results were mixed.

The company handily beat revenue expectations, but its losses were also worse than expected.

Revenue was $210.6 million, a 3 percent increase from the same period last year. Analysts surveyed by Yahoo Finance had been predicting $191.5 million.

But losses were 47 cents per share, when Wall Street was bracing for a loss of 42 cents.

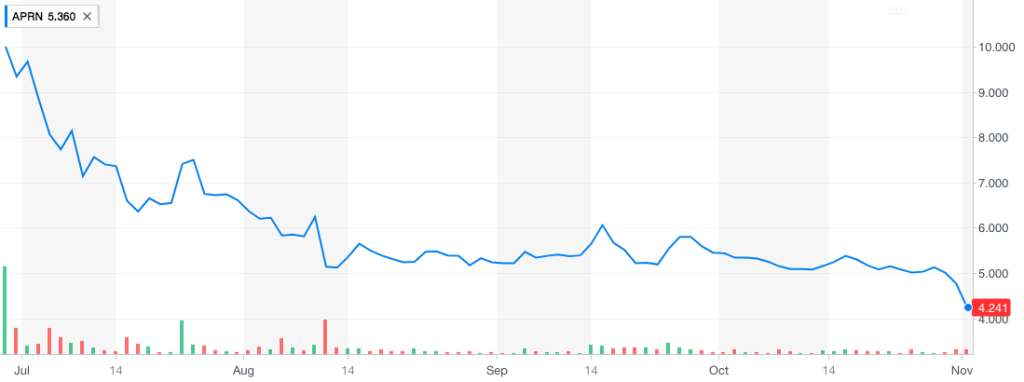

Shares traded down 9 percent by midday Thursday.

Part of the issue was that the costs of goods sold increased 13 percent from the same time last year. The company says it is “primarily as a result of increased costs associated with the launch of new operational infrastructure to support the company’s product expansion initiatives, including its new Linden, New Jersey facility.”

In addition to increasing costs, there have been other reasons for Blue Apron’s disappointing run on the stock market. Amazon bought Whole Foods just weeks before the IPO, and investors were concerned that this could be a threat to Blue Apron. The company has also struggled with customer retention.

But going forward, CEO Matt Salzberg said in a statement that “we are now focused on optimizing our operations so that we can drive progress on our product roadmap in order to further our mission to make incredible home cooking accessible to everyone.”