Startups in Silicon Valley, the epicenter of the tech world, and the U.S. overall have seen an unprecedented amount of investment as

consumers and businesses buy into more online services, and investors

flock to fund the next big thing. But the ripples of that trend are

being felt elsewhere, too. A new report says that London chalked up a

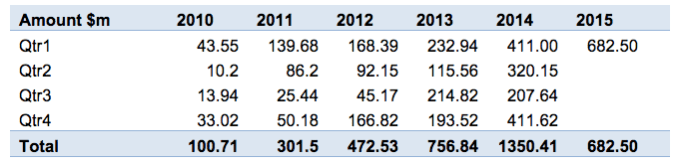

record $682.5 million of investment in the first three months of this

year, a rise of 66 percent on a year ago and busting through the

previous record of $411.62 million, set in Q4 of last year.

Startups in Silicon Valley, the epicenter of the tech world, and the U.S. overall have seen an unprecedented amount of investment as

consumers and businesses buy into more online services, and investors

flock to fund the next big thing. But the ripples of that trend are

being felt elsewhere, too. A new report says that London chalked up a

record $682.5 million of investment in the first three months of this

year, a rise of 66 percent on a year ago and busting through the

previous record of $411.62 million, set in Q4 of last year.At the current rate, investments in London startups are on track to break past $2 billion this year.

The figures, tracked by London & Partners, the mayor of London’s business development group, also speak to how out of balance the tech economy is in the U.K. That $682.5 million makes up 80 percent of all VC investment in the U.K. for Q1 ($856.7 million).

But they also point to the imbalance in the marketplace over a wider geography. In 2014, London startups attracted $1.35 billion in investment. In comparison, the National Venture Capital Association says that U.S.-based Internet companies took $11.9 billion of VC money in the year, while U.S.-based software companies attracted $19.8 billion in investment — both all-time highs.

In other words, if London is leading tech investment in European startups, Europe still has a very long way to go before getting anywhere close to the size of the U.S. market for tech, both in terms of businesses and those willing to back them.

Still, the market has come a long way when you consider that in 2010, London startups raised a mere $101 million.

London & Partners, working with data from CB Insights, says that money-transfer startup WorldRemit raised the most of any other company in Q1, a $100 million round in February.

Indeed, with the co-existence of a major financial center in the city, fintech startups have been some of London’s biggest startup successes. Others include TransferWise, which this quarter raised $57 million led by Andreessen Horowitz, which also put $20 million into Improbable, a platform that developers can use to create virtual reality experiences.

Virtual reality, in fact, saw two major investments, with Blippar also collecting $45 million in Q1.

Another category that has been strong in London is the wider area of e-commerce, and specifically in retail and fashion technology. Among these, Farfetch, which aggregates offerings online from smaller boutiques, took in an $86 million round led by DST.

“This quarter is the most exciting yet in London’s tech development, as we have seen companies based in the capital attract substantial new investments from some of the world’s most tech-savvy and influential investors,” said Eileen Burbidge, a partner at VC firm Passion Capital, in a statement. “London is one of the most electrifying tech hubs in the world, with companies and investors all brought here by the city’s ideas and entrepreneurial spirit, as well as its talent and access to markets.” The growth of London’s tech scene is also spawning a hiring spree.